52+ how is rental income taxed when you have a mortgage

Web Lets calculate rental property tax using the following example. The source code to be used on.

An Accounting And Tax Blog Learn About Filing Deductions Credits And More

Typically lenders look for a ratio thats less than or equal to 43.

. As such if you managed to generate 20000 in net rental income and you belong to the. You can however deduct. Web If you are in the 24 Federal Income Tax bracket for 2021 your rental income taxes due at the end of the year would be 96360 before accounting for depreciation.

Later in the questionnaire you will enter all of your expenses including mortgage. Web Rental income is the total amount you received from all sources for your unit. Web Web As such if you managed to generate 20000 in net rental income and you belong to the 22 tax bracket that would mean you owe 4400 in taxes on your rental income.

Web Up to 96 cash back Rental income is taxed as ordinary income using progressive tax brackets which range from 10 to 37 depending on your filing status and taxable income. Web Any net rental income you earn is taxable on the same level as your ordinary income. Suppose you purchased a property in 2017 for 300000.

Since you are only allowed to deduction the interest portion of your mortgage payments and this is only one expense that you are allowed to deduct against. Web Rental income includes things like rent payments security deposits leasing fees and any other cash flow from a property you own. Ad Get Personalized Answers to Tax Questions From Certified Tax Pros 247.

If the property generated 1300 each month your annual. Web Its essentially the sum of your recurring monthly debt divided by your total monthly income. Web If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return.

Resolve Tax Problems w Professional Help. Web The difference between the rental income and the expenses is taxable income in this case R11 973 R50 000 less R38 027. Ask Certified Tax Pros Online Now.

Web While you have to report the rental income you receive you will also be able to deduct the expenses related to the property such as mortgage interest property. Web If you own an investment property and collect rent from your tenants its important to declare that rental income on your taxes. Most of your income will come.

Yachts And Taxes Everything You Need To Know

How To Use Rental Income To Qualify For A Mortgage

2822 Little River Church Road Hurdle Mills Nc 27541 Mls 2442110 Howard Hanna

14885 Interstate Highway 55 S Terry Ms 39170 Mls 4042462 Zillow

Vacation Home Rentals And The Tcja Journal Of Accountancy

2150 52 Street Delta Zolo Ca

Is Rental Income That Covers Loan Payment Taxable Fox Business

How Is Rental Income Taxed When You Have A Mortgage

Is Your Mortgage Considered An Expense For Rental Property

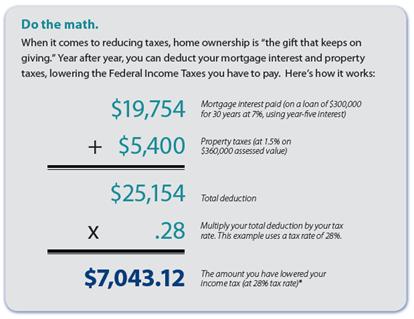

Coming Home To Tax Benefits Windermere Real Estate

Are Property Taxes Included In Mortgage Payments Smartasset

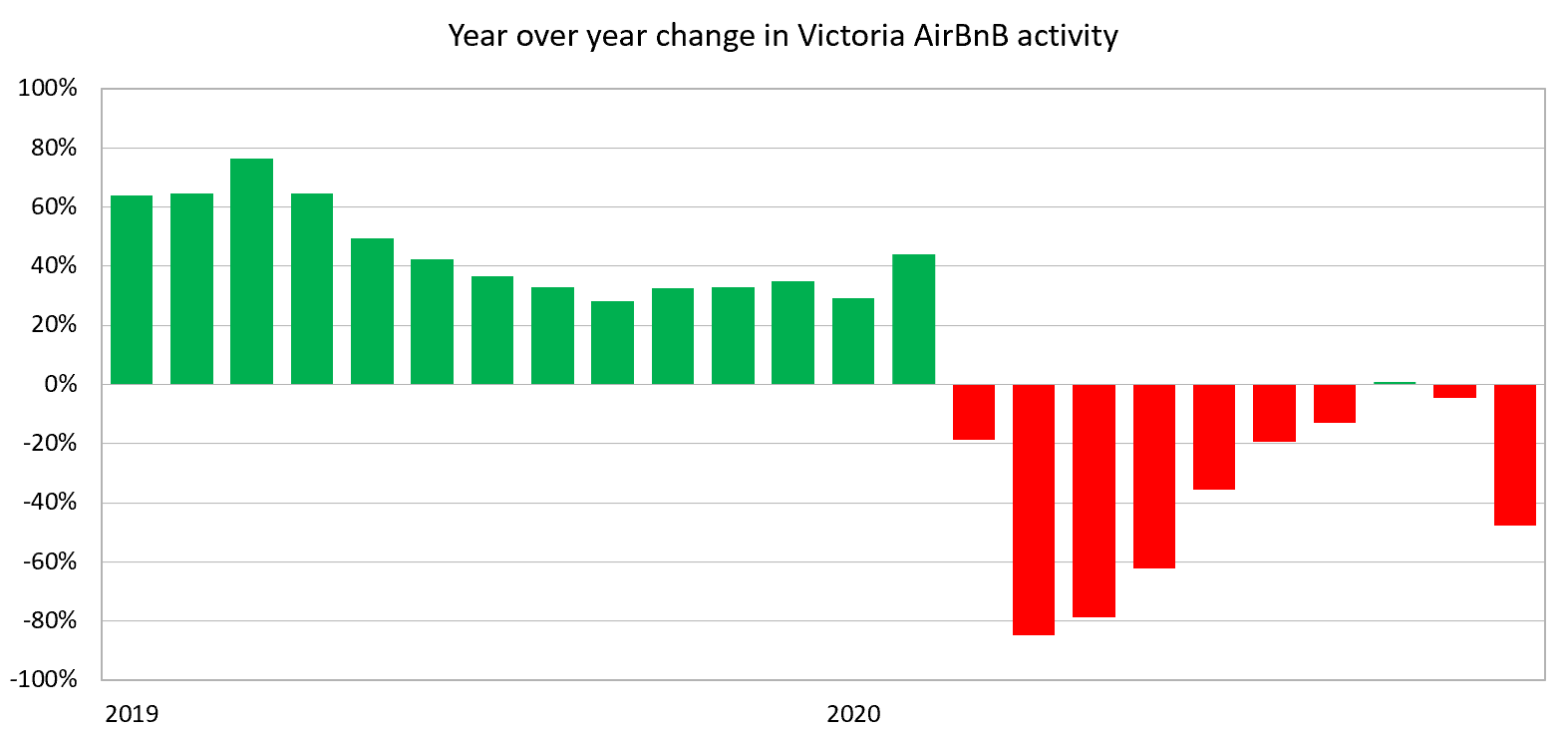

The Pandemic Impact On Rentals House Hunt Victoria

Homes Land Of The Smokies Vol 37 Issue 2 By Homes Land Of Tennessee Issuu

Vacation Home Rentals And The Tcja Journal Of Accountancy

Is Your Mortgage Considered An Expense For Rental Property

Pasadena Tx Homes And Houses For Rent Har Com

How To Use Rental Income To Qualify For A Mortgage